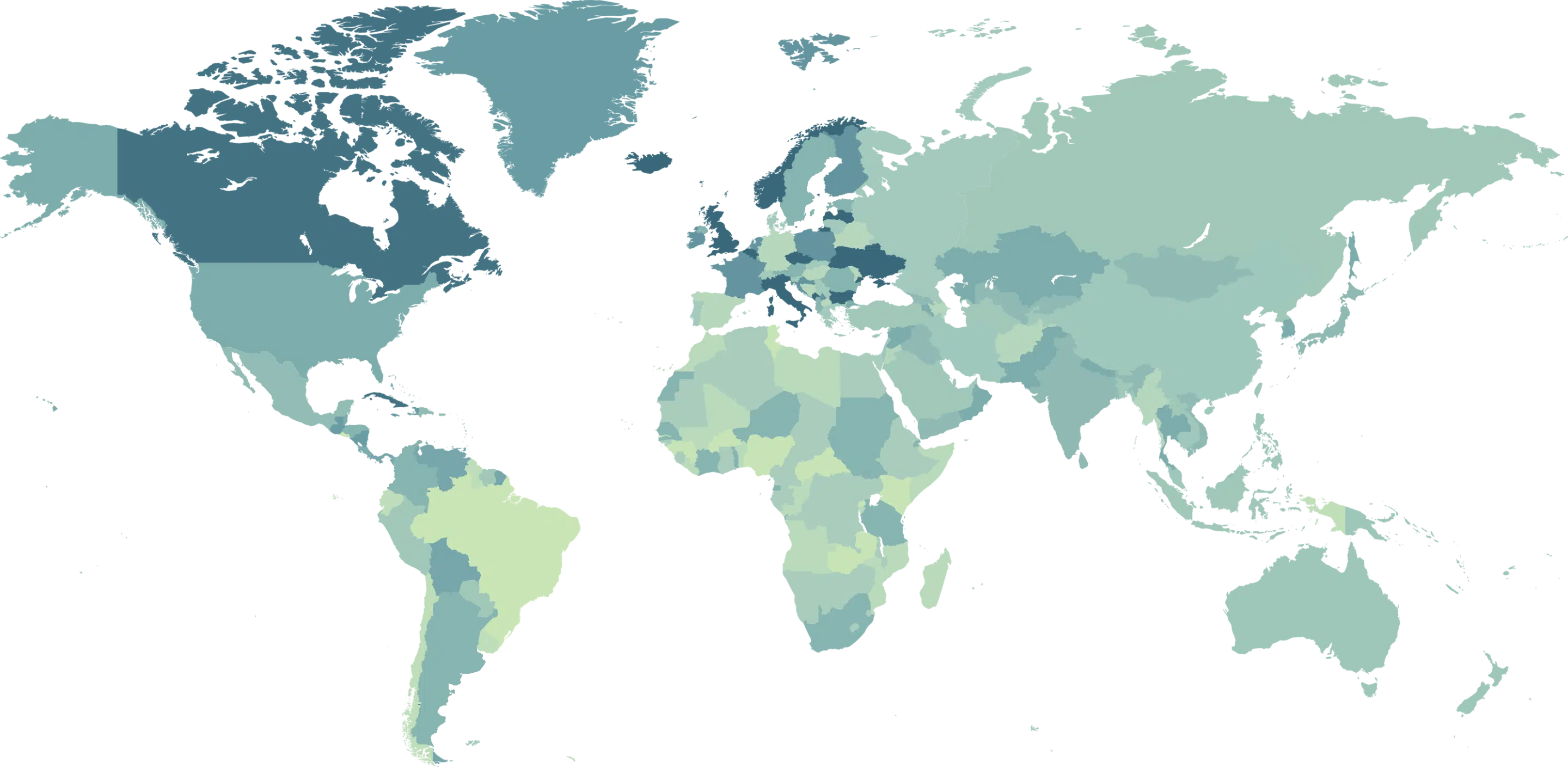

We offer clients Incorporation Services on a global scale

Offshore Incorporation globally with privacy & valuable advice

Why work with TBA?

We help you grow your business across international border and achieve financial efficiency conducting your affairs under absolute confidentiality.

Our Business Team is standing by to assist you with your enquiry with your specific requirements.

We shall answer you within 24 hours!

Competitive price policy

Offshore business experts

Fast and efficient execution

Integrity and due diligence

Dedicated customer relationship

Our Incorporation Solutions

TBA & Associates specialises in tailor-made wealth preservation solutions and provides tax efficient structures to facilitate cross-border transactions.

Please select one of our services to see more details.

TBA Services

We offer \Clients Incorporation Services on a Global Scale

Tax Planning Solutions

International Trade

Holding Companies

Trusts & Asset Protection Structures

Private Foundations

Financial Services Providers Registration

Forex, Crypto, ICO, Brokerage & Forex

Confidentiality and Anonymous Solutions

Worldwide Corporate Services

Bank Account Opening

Worldwide Full Serviced Virtual Offices

(Company Substance)

If you also seek to plan your affairs to maximize tax efficiency and to protect your wealth, then you should be talking to us. TBA & Associates specialises in tailor-made wealth preservation solutions and provides tax efficient structures to facilitate cross-border transactions.

Our team of specialists with their constant presence and guidance will enable you to make wise decisions and choices.

Where to Incorporate?

With TBA,

Entering International Markets is easy

The selection of the most suitable jurisdiction for either

International trade or Investment

Can often be difficult and requires very careful consideration

Check where we provide

Company Formation Services!

Readymade and Shelf Aged Companies

Shelf Companies allow you to engage into Business

Without having to go through the long waiting period of

Establishing a brand-new corporation

The acquisition of an offshore shelf company is fast, simple and offers essential advantages

Shelf Companies Advantages

Company available within a few hours

Immediate legal capacity

No liability risk

No debts or obligations

No previous activity

Financial Service Providers

Registration and Licensing Services

At most Relevant International Financial Centres!

TBA is one of the largest international corporate service providers offering innovative solutions, in the area of Asset Management, PSP, Crypto and Investment Funds.

All our work has strengthened our experience to select and propose the jurisdiction that most suit our client’s business needs.

Setting up your financial entity is only the first step

While we continue with ongoing support and maintenance

To ensure you remain licensed and full compliant to

All Regulator’s requirements.

Where TBA can successfully

Setup your Licensed Financial Company!

Some of the Most Relevant Jurisdictions

Where to get your Company Licensed

As a Financial Institution

Bank Account Opening Services

Opening a bank account for your company!

TBA has one of the world’s largest banking networks!

Our professional status as “International Corporate Service Provider” and

Our signing of a good conduct charter give us the status of

“Eligible Introducer”

As a result, opening an account and managing the dossier are much simpler and

We can open bank accounts remotely for the majority of banks we work with.

The New “Offshore” Solutions

The Offshore

The Developed countries and

Tax Authorities

In many circumstances, it is not desirable to raise invoices in the name of an exotic offshore company

Nor is it possible to ask your offshore company’s clients or trading partners

To make payments to a bank in an offshore tax haven!

That’s the Basic Now!

Remember that the books of your customers or trading partners

They are open to scrutiny by their local tax authorities and

Dealings with offshore havens (even if legal) are NOW viewed with suspicion!

Tax authorities of high-tax nations are aware that

Offshore companies can be used for illegal tax evasion

By businesses that need to “reduce” their taxable profits before year-end!

The New “Offshore” Solutions

The Offshore

The Developed countries

&

Tax Authorities

That’s why a properly configured and managed business structure can provide substantial tax benefits, protect assets, improve business efficiency, reduce costs and maintain confidentiality.

An improperly configured business structure is a recipe for disaster for the owner and his business!

Tax Planning Solutions

We are here to help structure

Your organisation and transactions

To maximize tax efficiency and Minimize risk

Tax planning is a process individuals, businesses, and organizations use to optimize their financial profile, minimising the amount of taxes paid on personal income or business profit.

If you’re operating across borders, or competing in multiple jurisdictions, complying with local tax laws, reporting requirements,

… TBA Team will be here and Ready to Help and Guide You

Asset Protection Solutions

At TBA we can help you creating wealth,

Protecting assets and extracting capital

From your business in the most tax efficient manner

Should you be considering protecting your assets from creditor claims. Individuals and/or business entities, and limiting creditors’ access to certain valuable assets, …

TBA will advise on the most effective asset protection structure, in a legal manner, applicable to your specific case and, … most importantly, helping you building the right structure before a claim or liability occurs, since it is usually too late to initiate any worthwhile protection after the fact.

Private Trusts

The Strongest Asset Protection Tools

Our Trusts are specially designed Trusts

That can effectively protect the Settlor’s assets

TBA Trust Services

PRIVATE CLIENT MANAGEMENT

A Trust is one of the most flexible existing financial mechanisms, with a concept based on the separation of legal ownership of the Trust assets (which rests with the Trustees) from the beneficial ownership (which rests with the beneficiaries).

It has been specially designed to achieve the best asset protection.

A Trust is a legal device that allows title to – and possession of – property (asset) to be held, used and/or managed by one person, the trustee, for the benefit of another different person or group, the beneficiaries.

In some privacy aware jurisdictions, the terms of the Trust agreement and the Beneficiaries are protected against disclosure.

To full protect your assets against any eventual risk of lawsuit, and keep them under full confidentiality, our Team of experts will be ready to help and guide you through the right and proper Trust Structure for you!

Where to incorporate your Asset Protection Trust!

Where TBA can setup your

Private Interest Foundation!

Wealth Planning Solutions

TBA offers a specialised service in Wealth Protection Planning

We assist professionals and their clients to develop

Appropriate Asset Protection Strategies to Preserve Wealth

Unless the proper techniques of wealth protection are applied

Much of your wealth can be lost in coming years

Due to the failure of benefactors and their advisors

To take the appropriate steps to protect their assets

From a variety of risks and contingencies!

TBA offers a specialised service in wealth protection planning!

Setting up your Holding Company

Holding companies can substantially

Reduce the taxable profit of the subsidiary companies

By invoicing the subsidiaries in respect of their activities

Holding Advantages

A holding company usually collects the dividends (profits after tax) of the subsidiary company as free from tax as possible.

In addition, further distributions from the holding companies, in best-case scenarios, they are full tax exempted – no tax on dividends being paid to the shareholders.

In case the subsidiary companies are located within the European Union, Cyprus and Netherlands, in particular, there will be no taxation of proceeds purely from holdings, while Cyprus will be tax exempted at source in the event of further distributions to non-Cypriot owners, and even under non-DTA circumstances, active income is taxed at a rate of only 12.5%.

Where to Register your Holding Company!

Private Foundations

Succession Planning!

Tax Planning!

Wealth Preservation and Asset Protection!

No Reporting Requirements or Taxes

Anonymous Ownership and Control